Current Housing Market: Is It a Buyer’s Market or a Housing Shortage?

One of the questions that often comes up is how to make sense of the current housing market.

It can feel like a buyer’s market in some respects, yet we’re constantly hearing about a persistent housing shortage.

So, which is it? The answer, perhaps surprisingly, is that it’s a bit of both.

Understanding the current dynamics is key. The housing market is complex, influenced by local successes and broader economic forces.

Let’s look at a specific example of how supply impacts affordability locally, and then explore some national trends, with insights from analyst Peter Zeihan, that are shaping the future of housing costs and availability, creating this seemingly contradictory environment.

Table of Contents

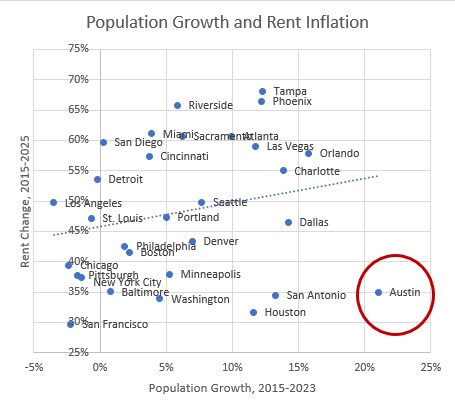

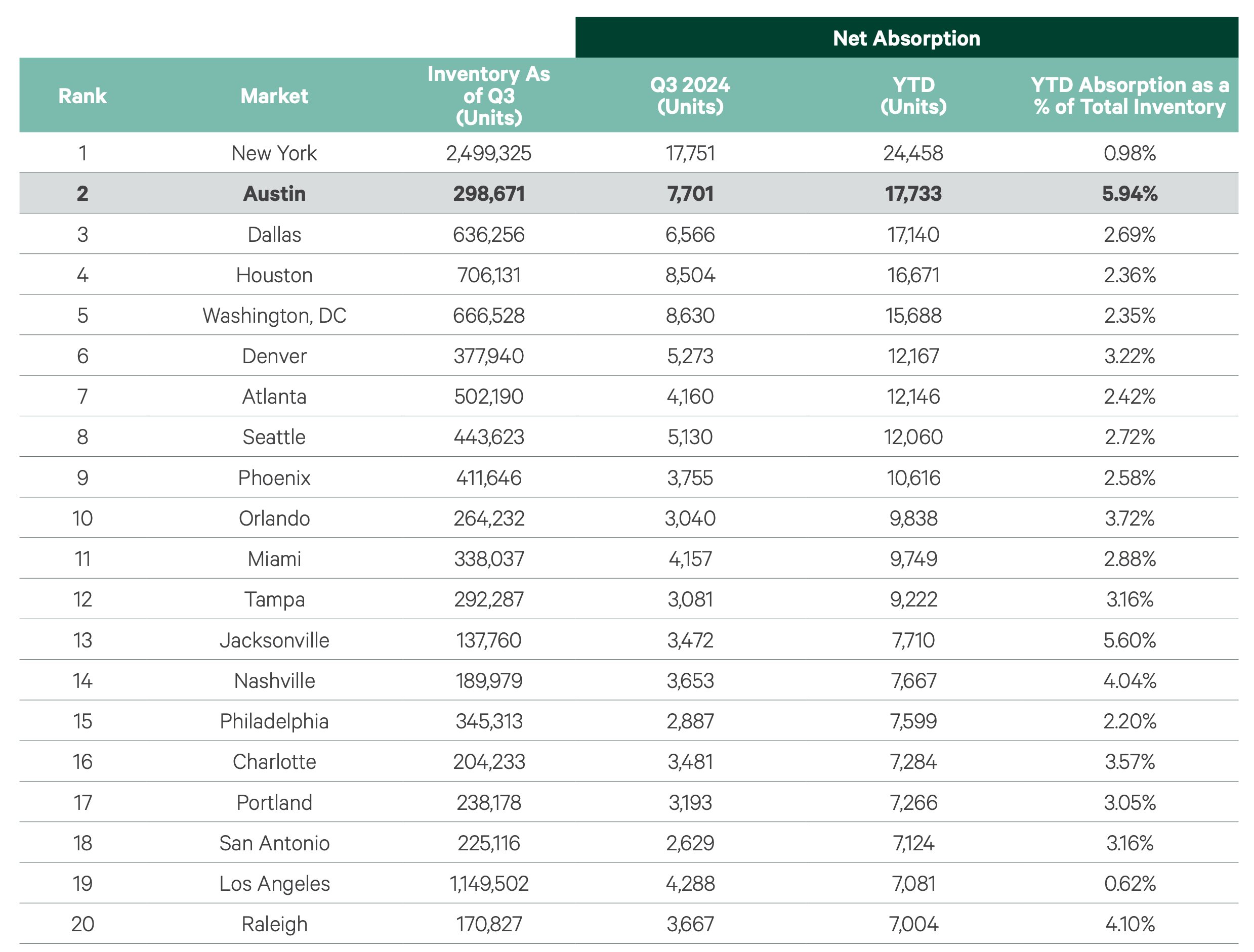

How Austin Managed Rent Growth

It might surprise some Austinites, but when you look at the data, we’ve actually done a much better job controlling rents compared to many peer cities experiencing similar growth. How? By increasing supply.

We achieved this through significant new construction and absorption. “Absorption” simply means the number of new apartments leased during the year. Strong absorption indicates that the new supply is being met with demand.

Austin’s experience suggests that actively increasing housing supply can be a powerful tool to moderate price increases, even in a high-growth environment.

Housing is Getting More Expensive

While local efforts like Austin’s matter, broader economic factors significantly impact housing supply and cost across the country, contributing to the ongoing shortage.

Analyst Peter Zeihan points out several key pressures:

Rising Mortgage Costs

Getting a mortgage is fundamental to buying a house for most people, and costs are climbing.

Zeihan notes multiple factors, including potential government deficit spending increasing pressure on the debt market (which influences mortgage rates) and crucial demographic shifts.

He explains the impact of Baby Boomer retirements:

“Most of the free capital in a system comes from a population of people aged 55 to 65 who haven’t yet retired but are preparing to… Well, as of January of this year, two thirds of the American baby boomers, the largest generation we have ever had, have retired. That liquidation has already happened… It hasn’t been Covid, it hasn’t been Biden or Trump or the Fed. It’s just been the boomers doing what you do when you retire, while that hits mortgage rates as well.”

In essence, as a large generation like the Baby Boomers retires, they often shift their investments from growth-oriented assets to more conservative ones, or liquidate assets to fund retirement.

This transition can reduce the overall pool of “free capital” available in the financial system for things like mortgages.

With less capital chasing lending opportunities, the cost of borrowing (i.e., interest rates, including mortgage rates) can face upward pressure.

Construction Challenges

Building new homes faces multiple hurdles.

Labor is a significant factor, with Zeihan noting that the construction industry heavily relies on migrant workers, and any changes to workforce policies can impact availability.

Furthermore, the costs of essential building materials are rising due to various pressures.

“In addition, we have tariffs on steel and aluminum, which are two of the four biggest components that go into home building. The other two being copper and wood, which are also under sanctions. So all of the inputs that are necessary to build a house in the first place are seeing their prices go up even as finance goes up.”

Insurance Premium Hikes

The rising costs of materials and labor also affect insurance.

If rebuilding is necessary, the costs are higher, leading to increased premiums.

Zeihan points out that these insurance premium hikes are substantial, adding another layer of expense for homeowners and prospective buyers, further straining affordability.

Demographic Lock-In

Unlike previous generations, Baby Boomers are often choosing to age in place rather than downsizing, keeping a large portion of existing housing stock off the market.

“Unlike the generations that have come before who move into smaller units when they retire… boomers are far more likely to stay in their home and age in place… what it does mean is the single largest concentration of homes that owned by the boomers is not getting freed up as part of this demographic turnover.”

Zeihan summarizes the challenging situation this creates, particularly for younger generations:

“And so if you are a millennial and especially a member of Generation Z, the quantity of housing simply isn’t there. The older generation is staying in place. The newer construction costs more. The home insurance that you have to get to get the mortgage costs more, and the mortgage, mortgage itself costs more. You add it all up and housing is just expensive and only going to get more. So we cannot build it fast enough. And even if we could, the components that go into it are more expensive than they have ever been relative to the average income.”

Watch the full video below for more of Peter Zeihan’s insights:

Conclusion

So, how do we reconcile the feeling of a buyer’s market with an undeniable housing shortage?

The Austin example shows that increasing supply can make a difference locally, potentially creating more favorable conditions for buyers in specific areas or segments.

However, the national picture presented by analysts like Peter Zeihan highlights significant headwinds: rising finance costs, increased construction expenses (both labor and materials), higher insurance rates, and demographic trends limiting existing home availability.

In addition there are a multitude of future home buyers waiting to buy — it could be because the economy seems precarious, but primarily they want lower interest rates. So there is a lot of pent up demand that eventually will flow into what are ultimately inventory restricted markets.

These factors combine to maintain a fundamental shortage and make housing more expensive overall, particularly for those trying to enter the market.

While it’s great news for existing homeowners whose equity grows in an inflationary environment, it presents real challenges for first-time buyers and younger generations. It creates a market where, despite some buyer leverage in certain situations (perhaps due to sellers needing to move or specific property types), the underlying lack of sufficient, affordable housing persists.

Understanding these complex, sometimes contradictory, forces is the first step. The next is navigating them effectively.

You might also find my discussion on the market moving towards a buyer’s market insightful.

When you’re ready to make a move, knowing how to evaluate offers is crucial. I cover the key contract elements that protect your interests in my guide on essential contract terms for real estate.

If you have questions about how these trends affect your specific real estate goals, whether buying, selling, or investing, let’s talk.